Search

Search

To Our Valued International Partners,

In today's competitive chemical industry, every opportunity for cost optimization translates directly into enhanced market competitiveness and improved profit margins for your business. Have you ever explored fully compliant, strategic methods to significantly reduce the tax burden on your imports from China?

We are pleased to present a definitive solution.

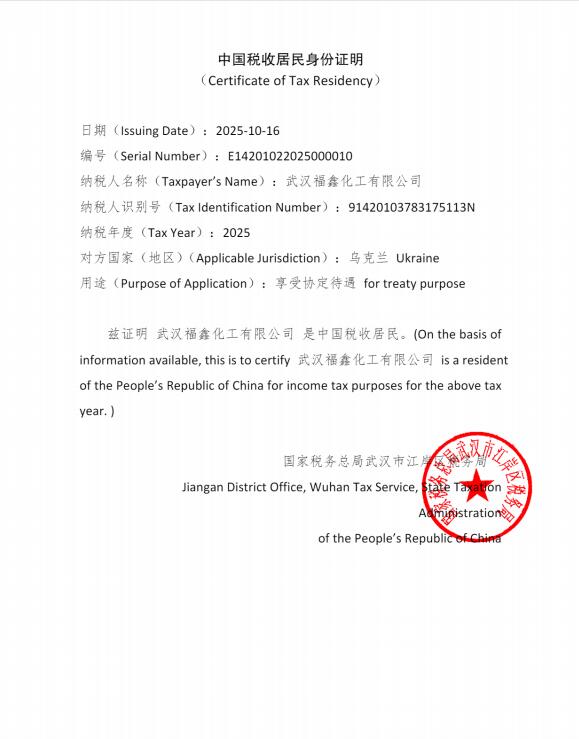

At Wuhan Fortuna Chemical Co.,Ltd, we pride ourselves on being more than just a reliable supplier of high-quality chemical products. We are your strategic partner dedicated to empowering your entire supply chain value. To that end, we are proud to offer our exclusive Chinese Tax Resident Certificate (TRC) Support Service, designed to help you legally capitalize on preferential tax treaties in your country, achieving a breakthrough in reducing your import costs.

This is not merely a document; it is your key to unlocking substantial tax savings.

Direct Reduction in Customs Duties: Many countries have established Double Taxation Avoidance Agreements (DTAAs) with China. By presenting the official Chinese Tax Resident Certificate we provide, you can apply for significantly reduced treaty benefit tax rates upon customs clearance, as opposed to the standard higher rates. This can lead to a direct reduction in your payable duties by 5% to 20% or more.

Enhanced Price Competitiveness: Lower import costs immediately increase the competitiveness of your end-product pricing, allowing you to capture a larger market share.

Boost to Net Profitability: Every dollar saved through this channel flows directly to your bottom line as pure profit, available for reinvestment, marketing initiatives, or business development.

Without a valid TRC, your imports from China are likely subject to non-preferential, standard tax rates. This means you could be consistently paying an "unnecessary premium." We believe our partners should not bear avoidable expenses.

We understand that navigating international tax documentation can be complex. Therefore, we have streamlined the entire process to ensure effortless implementation for you:

We Manage the Entire Process: Our dedicated team in China will handle the entire application with the State Taxation Administration to secure the official, valid certificate on your behalf.

Minimal Effort Required: You can remain focused on your core business. We only require basic clearance information from you to initiate the process.

Guaranteed Compliance and Authenticity: We ensure the entire procedure adheres strictly to Chinese regulations, delivering a 100% authentic and legally sound document for seamless customs clearance.

This service is a core part of the value-added support we provide to our strategic partners at Wuhan Fortuna Chemical Co.,Ltd, and we will process your TRC application completely free of charge. We are committed to your success, as it is intrinsically linked to our own.

The next step is simple.

On your next purchase order, or by directly replying to this message, simply express your interest. Your dedicated account manager will immediately initiate the application and guide you on its utilization for your customs clearance.

Do not let potential profits erode through unnecessary tax payments. Click here https://www.fortunachem.com/ to contact us immediately and discover the exact savings you could qualify for.

Partner with Wuhan Fortuna Chemical Co.,Ltd for not only premium chemical products but also for an unrivaled strategic cost advantage.

Sincerely,

The Team at Wuhan Fortuna Chemical Co.,Ltd

— Your Trusted Partner in Chemical Sourcing and Supply Chain Optimization

Quick Links

Add:

E-mail:

English

English  Español

Español  français

français  العربية

العربية